Adsterra works with thousands of affiliate marketers around the world, and they use our network to find suitable offers. If you’re an affiliate looking for fair commission rates and non-hackneyed offers, it’s advisable to join the Adsterra CPA Network because you can find competitive offers.

Advertisers often ask us what affiliate commission rates they must pay to get good marketers. The answer varies, as several factors go into deciding the best affiliate fees.

This article outlines the factors and processes to establish ideal commission rates for your brand.

What are affiliate payouts?

When you run your own program and have a direct agreement with your affiliate partners, you’ll have to deal with affiliate commissions. On the other hand, when going for the much more manageable “affiliate payouts for conversions” (usually CPA, CPI, CPL), you’ll deal with established affiliate networks like Adsterra CPA Network.

In general, you have to learn how to choose the optimal payout for advertising your offer (how much we are willing to pay for the conversion). We mean:

- Setting a limit on conversions for new affiliates and checking the quality of traffic;

- Imposing traffic restrictions (geo, devices, OS, browser) and its cost (iOS and Tier-1 traffic is traditionally more expensive);

- The fact of conversion, i.e., what exactly is a successful conversion: download, install, subscription, lead, click;

- The payment depends on the budget, the proposed campaign’s duration, and the conversion’s complexity.

If you need to get results quickly and are ready to pay a lot, it is better to contact a CPA network to make your offer private (i.e., accessible only to advanced affiliates).

A call for affiliates looking for high payouts! Adsterra CPA Network partners with reputable brands and advertisers who share exclusive offers with us. You can enrich your income sources today!

Payouts for complex conversions

Complex affiliate conversions cost more than simple ones. Such conversions include purchases, recurring subscriptions, re-deposits, etc. For example, some banking apps pay $100 for a client’s first deposit (if the deposit is more than that amount).

The focus here is not on the number of conversions but the quality. Advertisers may get relatively few conversions, but they are very valuable ones that’ll reap future rewards. The payouts are usually cheaper in some geographical locations than others. For instance, a sign-up from the U.S. costs much more than one from Cambodia.

Estimating the ideal affiliate marketing payouts for complex conversions is difficult, so you may need the help of your assigned affiliate program manager.

What is the average affiliate commission rate?

The average affiliate commission rate is between 15% and 25%, and the median hovers at 20%. Some industries offer higher rates than others, e.g., finance, fashion, health & wellness, etc.

If you’re offering below the average rate, you’ll need a compelling reason to do that. Even if you’re selling an exceptional product, a low commission will discourage marketers. It’s ideal to have a tiered commission structure such that marketers bringing in more sales get higher commissions.

Why are competitive affiliate commission rates necessary?

Commission rates usually consist of two parts: a base rate and bonuses. It can be tempting to keep them low to maximize your profits. Offering higher rates may result in higher conversions because affiliates gain a financial incentive to perform well. While you may be paying each affiliate a higher commission per sale, you might see an overall increase in sales.

When calculating the commission amount, you should also consider your competitors’ rates and other factors like Margins, Customer acquisition costs, and Discounts/promotions.

What affects average affiliate commission rates?

1. Profit margins

The primary factor affecting your affiliate fees is your profit from selling products. For instance, if your profit margin is 20%, offering a 30% commission would be illogical because you’ll lose money. Hence, the first consideration is that your commission percentage should be lower than your profit margin.

You should also identify factors affecting your profit margin, e.g., return rate, fees, advertising, etc. This will help you decide your budget limit and calculate an ideal payout rate.

Calculating the profit margin for an affiliate program

The first thing to measure is the average lifetime value of your referred customers. This refers to an estimate of the net profit that each new client brings for your business over their lifecycle.

After calculating the average customer lifetime value (CLV), deduct the average cost of getting a new client. The positive difference between these two values is your profit margin.

2. Costs of acquiring new customers

The next important factor is the average cost of acquiring new customers, which we mentioned in the above section. But, you should also be concerned about the average cost of acquiring new customers from mediums outside affiliate marketing.

Calculate the average commission percentage for getting new customers across all marketing mediums, and your payout should fall within this range.

3. Promotions and discounts

Consider promotional costs to determine your payout rate. Many advertisers overlook this figure and lose money, so you should avoid doing the same thing. For instance, if you’re offering a 5% discount on a purchase, include it as part of your customer acquisition costs. The same applies if you offer free samples, buy one get one free, free shipping, etc.

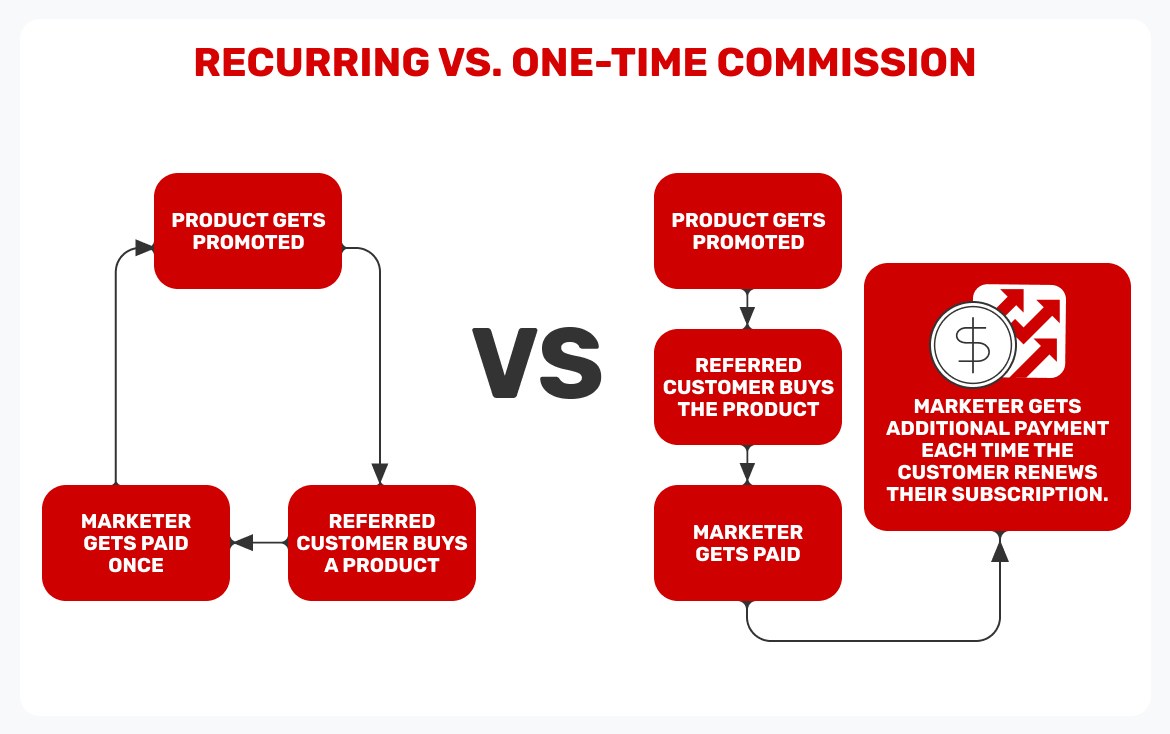

A very common question in this industry is if marketers prefer higher one-time commissions or smaller recurring payouts. Nowadays, marketers prefer recurring commissions because they bring stable income over a long-term period.

For instance, marketers for software-as-a-service (SaaS) products can earn commissions each time a referred client renews their subscriptions. This brings in stable income over the long term, which is preferred over unstable yet probably higher incomes.

High commission vs low commission rates: which is better?

There’s no single better option, as it depends on the value of the product you’re selling. A 40% commission on a $100 product is less valuable than a 10% commission on a $1,500 product. The commission rate depends on the price of your products and how many you expect to sell over a given period.

High-value retailers can offer lower commissions because marketers will make a significant sum from relatively few sales. In contrast, people selling low-priced or mid-range products need to offer a higher affiliate marketing commission.

Affiliate commission structures

The standard commission

This structure is the most common type for affiliate programs. The marketers get a fixed percentage or sum for every conversion they drive. For instance, if they drive a sign-up to your website, you’ll pay $20, or if they refer a purchase for your product, you’ll pay a 15% commission. This arrangement is simple for both the advertiser and the marketer.

First-time affiliate bonuses

This structure is what you choose to entice marketers to advertise your products. You can offer a small one-time bonus, e.g., $10 or $20, to every marketer who signs up for your program. Alternatively, you can offer higher commissions for a limited time for each new marketer. This structure is recommended for new businesses that want to build long-term relationships with marketers.

VIP commissions

All affiliate marketers aren’t equal. Some generate more revenue than others, so give high-value promoters higher commission rates. This will encourage them to advertise your products effectively and help you build profitable long-term relationships. This structure is more prominent for retailers offering expensive products.

New affiliate commission

This structure is akin to a referral program. You can pay affiliates each time they refer a new affiliate to your program. You could pay a one-time bonus or offer a percentage of the referred marketer’s fees. This method is best used by new retailers that want to build long-term relationships with a network of marketers to drive more sales and following.

Tiered commission

A tiered structure means marketers’ commissions depend on the revenue they bring in. They’ll earn a specific commission up to a specific sales volume, e.g., $5,000. After hitting that sales volume, their commission increases, which continues on your chosen scale. This structure motivates affiliates to achieve their sales targets and close more deals.

Revenue Share

In this model, advertisers share a percentage of revenue generated from the campaign with the promoter. It’s beneficial because marketers are more willing to go the extra mile to advertise your products when they’re sure of getting a significant percentage of total sales. Revenue share can be up to 50% for high-value products.

Guide to calculating your affiliate commission rate

1. Choose a type of affiliate commission

The first thing to decide is what type of commission you want. Do you want to pay a fixed percentage of sales or a flat fee? Percentage commissions are the most common, with an average rate of 15% to 25%. Yet, you can choose to pay a flat fee for each sale; this method is preferable if you sell relatively few but expensive products over a period.

2. Estimate the average lifetime value of your customers

You need to calculate the average lifetime value of your customers to determine an ideal rate to pay affiliates for referrals. This value is an estimate of how much an average customer brings in over the span of your relationship. Also, answer these questions:

- What is the average cost of getting a new customer?

- What percentage of new customers do you retain in a given year?

- What is the maximum revenue you can get from a customer?

These questions help you determine ideal affiliate fees.

3. Check your competitor’s rates

Competition plays a big role in the affiliate marketing industry. Check what your direct competitors offer to affiliates to get a clue of what you should offer. If you offer lower fees than your competitors, you’ll likely lose affiliates, so offer similar or maybe higher fees.

Fees aren’t the only concern. Review these questions about your competitors:

- What actions trigger the payout? Sign-up, purchase, subscriptions, etc.

- Do they offer a percentage or fixed amount for a referral?

- Do they have a VIP commission program?

- Do they use a tiered commission structure?

4. Set a lower rate for your first commission

After researching your average customer lifetime value and your competitor’s commission rates, it’s time to set your own. It’s advisable to start with a relatively low commission rate, as it gives you the flexibility to raise it later.

Affiliates won’t mind starting with a low rate and increasing it later, as this means more money. In contrast, if you start with a high commission and decide to lower it to cut costs, you’ll discourage affiliates.

5. Determine commission bonuses

We recommend giving bonuses to top affiliates. The bonuses encourage them to continue bringing in sales and recognize their effort to stand out from the rest. You can award bonuses in various ways:

- Higher commissions if a marketer crosses a specific sales volume.

- A one-time bonus when they reach a specific sales volume.

- Recurring bonuses when a referred customer renews their subscription.

6. Set the affiliate program’s terms and conditions

You need to specify the binding terms and conditions for your affiliate program. State these clearly:

- If the marketer receives a commission after someone clicks their link for a specific period.

- Your payment schedule, e.g., weekly, bi-weekly, monthly, etc.

- What payment platforms do you use?

- How you will track affiliate performance, e.g., web cookies.

Your terms & conditions document should be easy to read and understand.

7. Change your commission rates frequently

You must not keep your commission rates constant. You can tweak it regularly to keep marketers engaged and on good terms with your brand. For instance, if your competitors are increasing their rates, it’ll be wise to follow suit. Similarly, you can increase your rates temporarily during periods of higher sales, e.g., festivities. You can also give a surprise bonus to effective marketers at random times.

If you own a product, you can promote it via an ad network. Just like affiliates, you will have full access to billions of ad views around the globe. Adsterra ad network is a proven traffic source that delivers over 1.34B conversions annually.

Advantages of commission-based affiliate marketing

- Marketers are willing to put in the effort to promote your products when they’re sure of getting a cut of each sale.

- You can consider the cost of commissions when setting your price and maintain a healthy profit margin.

- It is one of the most effective ways for online retailers to promote their products.

- It is more cost-effective than other types of advertising. In this case, you only pay when a product gets sold, unlike others, where you pay regardless of whether items get sold.

10 most popular affiliate industries

Some industries are better known for incorporating affiliate marketing than others. For instance, most health & wellness product retailers run affiliate programs to drive sales. Similarly, financial services providers run lucrative affiliate programs to drive sign-ups. The 10 most popular industries for affiliate marketing include:

- iGaming

- E-commerce

- Finance

- Fashion & beauty

- Education

- Technology

- Health & Wellness

- Food products

- Gaming

- Pet care

- Sports gear

- Luxury

Conclusion

Setting commissions is one of the most important stages of the offer’s success. We hope our guide has highlighted the vital aspects to consider. Both Adsterra platforms — for advertisers and affiliates — will lift your profits if you look for quality traffic or high-paying offers.

FAQs about affiliate commission rates

The average commission rate lies between 15% and 25%, and the median is around 20%. Anything with the average range is a good cut. Anything below 10% is unsuitable, but there are exceptions for high-value products.

First, you need to find a good affiliate network to sign up on, e.g., Adsterra CPA. Then, you’ll select affiliate offers to promote. You can promote these offers on your websites or social media pages and earn commissions if you refer a sale, sign-up, or any other conversion.

Referral marketing utilizes your customers to spread the word about your brand to their families and friends. In contrast, affiliate marketing relies on third-party promoters to spread the word to a larger circle.

Referral depends on close relationships, while the other requires no close relationship between the affiliate marketer and the referred customer.

It is a cost-effective way to promote a product or service. The marketer earns a commission only when they drive a sale or conversion, so you’re sure of getting results for the money you pay. Marketers also put in the effort to spread the word about your products because they’re sure of getting a percentage of each sale.